After weeks of tackling the big social issues facing the country in its recovery from Covid-19, last week we reached our final Feeder Event of the Summer. The Challenge at hand was to Create Prosperity, looking to improve financial inclusion and resilience in our communities, to enable sustainable prosperity and growth.

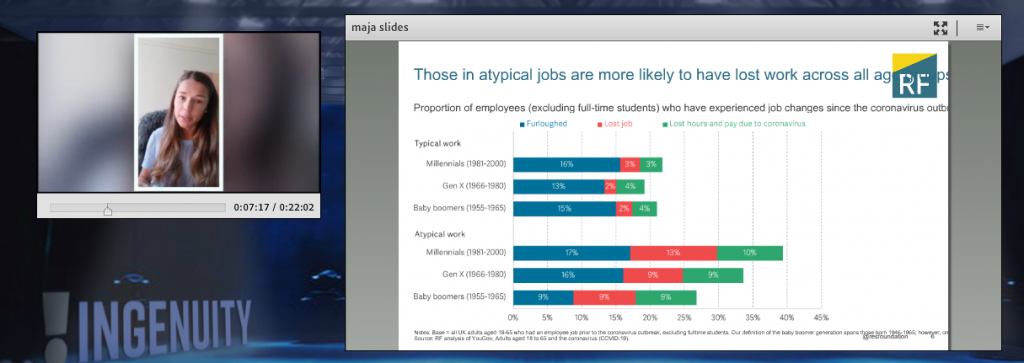

The current Covid-19 crisis has magnified and worsened many of the key issues people living in poverty or financial instability face. “Millennials were already on the back foot going into the crisis”, said our first Keynote Maja Gustafsson (Resolution Foundation), who gave a thought-provoking talk on some of the economic victims of the pandemic, including many young people in the gig economy.

On Day Two, Heather Williams from Demos spoke about financial inclusion and the plight of many “credit invisibles”, who often live in cities where they will likely be surrounded by many good credit options but lack the means to access affordable financial services.

After being led into group sessions on the Ingenuity Process by Dr David Achtzehn, the participants were tasked with identifying a problem and working to find a business solution before pitching to our judges on Day Three.

The first winner was Sandhya Ramula, an MBA Scholar from Warwick Business School, who is passionate about Financial Technology solutions that are aimed at solving fundamental and prevalent socio-economic problems.

She was awarded £2,500 to help fund her business plan, ‘SavingHood’, which will offer a digital platform for community driven personal savings and financial management.

“COVID19 adds to the pre existing socio-economic inequality and wealth gap – this makes it even harder to make significant changes in their wealth status, be it aspiring to climb the property ladder, starting a business or paying tuition fee for a life transforming course”, said Sandhya. “SavingHood aims to leverage the digital environment making it safe and efficient to save while helping bring thousands of unbanked members of society into the mainstream financial system.”

Sharing top prize was a team made up of two University of Nottingham Witty Scholars, Max Johnson and Tapiwa Kampila, who teamed up with Law graduate Michael Owiredu to tackle financial exclusion for refugees.

“I am passionate about making positive social contributions, including giving back to my community, and being a voice for underrepresented and overlooked groups, particularly by encouraging better financial decisions”, said Michael.

“We were very pleased with the outcome, having put in a lot of work and effort in the few days we had to develop our ideas It was a really enriching experience and we look forward to the next steps.”

If you’re interested in improving financial inclusion and helping to create resilient communities, as well as gaining access to these insights and more, sign up to our Develop Platform from 14th September.